what is a fit deduction on paycheck

FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions. An individuals paycheck for state income taxes.

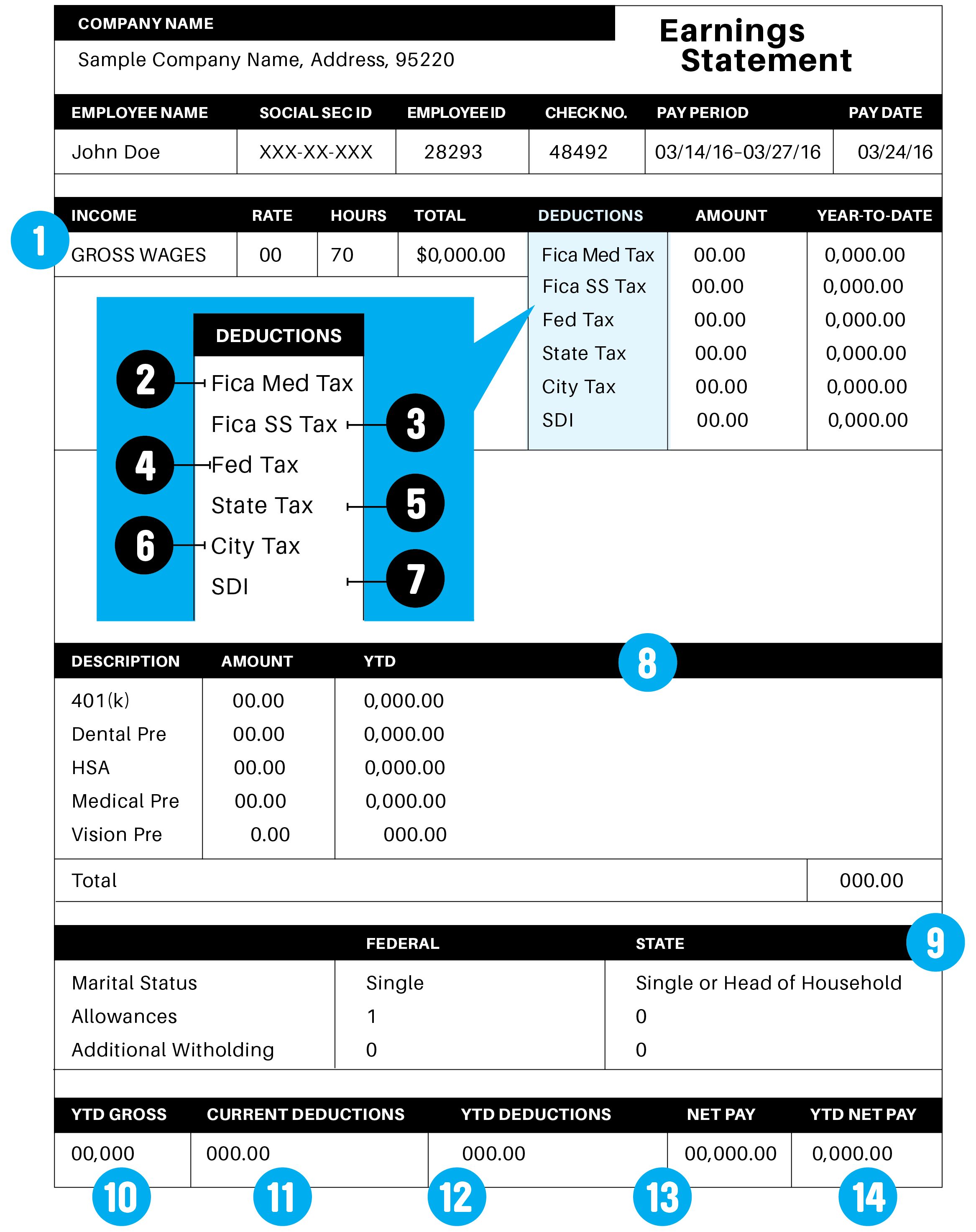

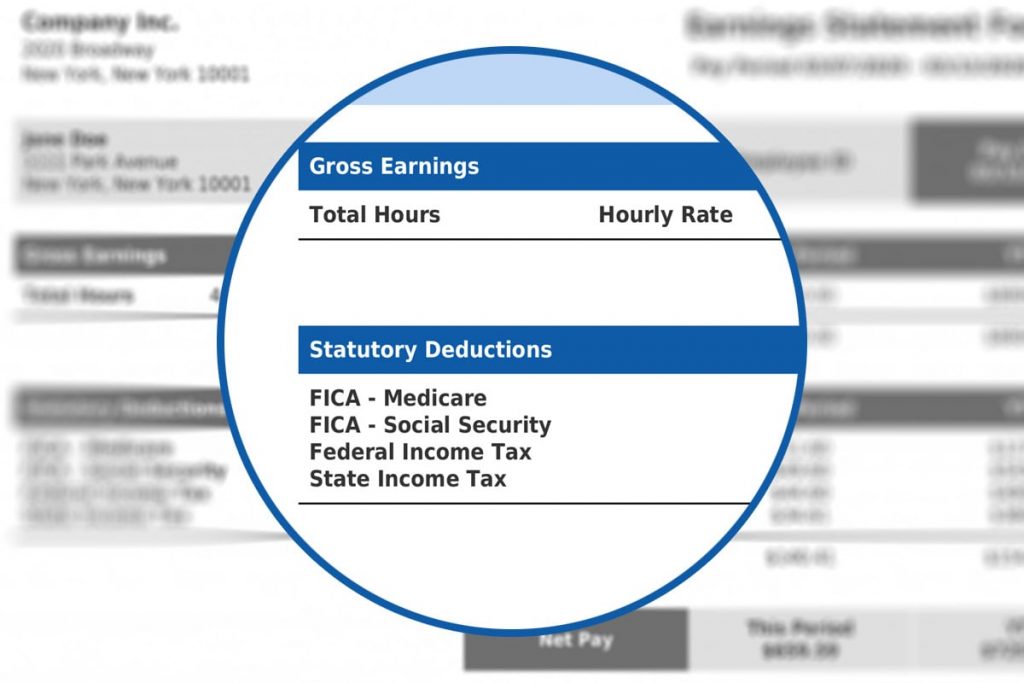

Breaking Down Paystub Deduction Codes Paystubcreator

This is the amount of money an employer needs to withhold from an employees.

. Federal income tax deduction can be abbreviated fit deduction. If you work for yourself you need to pay the self-employment tax which is equal to both the employee and employer portions of the FICA taxes 153 totalLuckily when you file your. Employers withhold or deduct some of their employees pay in order to cover.

FICA means Federal Insurance Contribution Act. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax. What is a FIT-S-O payroll deduction.

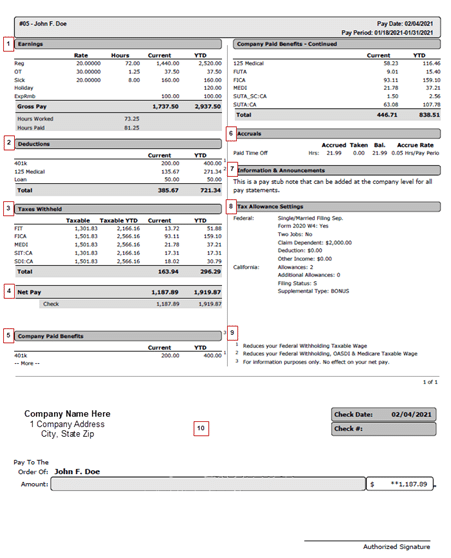

FIT deductions are typically one of the largest deductions on an earnings statement. FIT means federal income taxes. 0765 for a total.

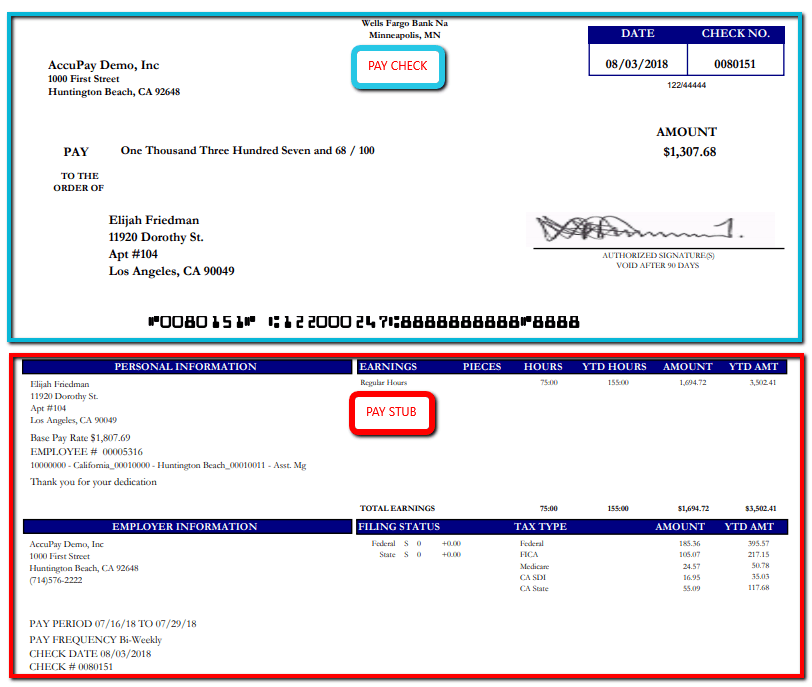

Employees generally receive a paycheck along. Half of the total 765 is withheld from the employees paycheck and half is paid by the employer. Federal income tax deduction refers to the.

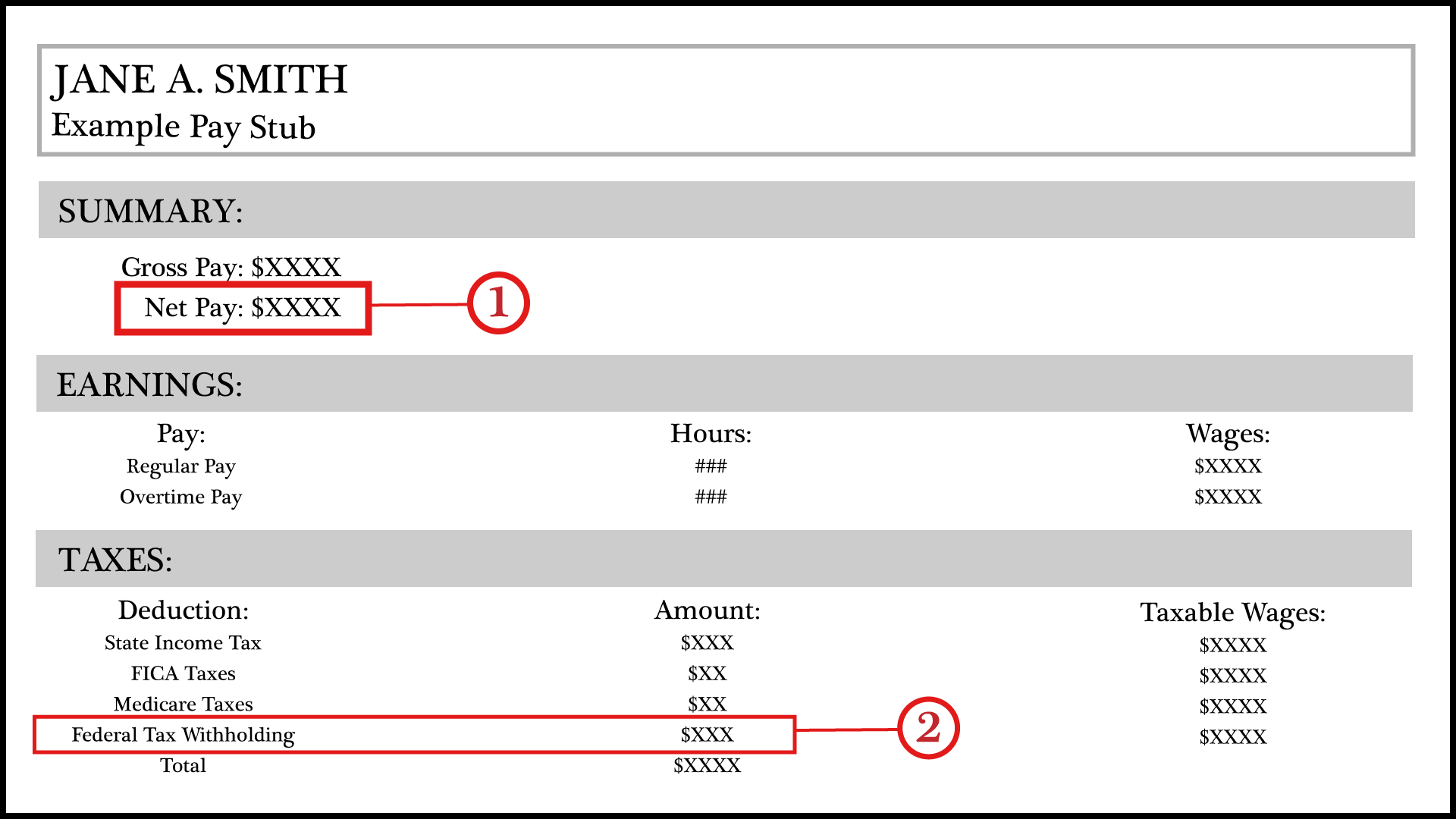

Net pay Net pay is the amount you take home after deductions. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. I expected - for a two week pay.

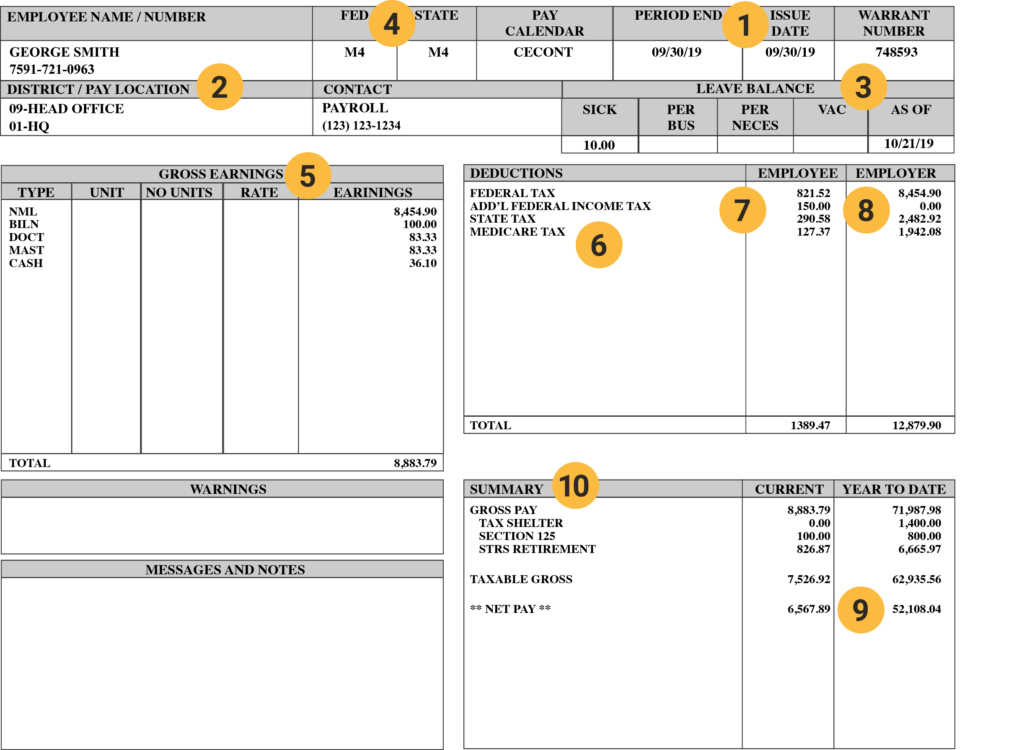

FIT Federal Income Tax. It covers two types of costs. The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you.

Below you will find some of the most common deduction codes that appear on your pay stub. FIT deductions are typically one of the largest deductions on an. FIT deductions are typically one of the largest deductions on an earnings statement.

TDI probably is some sort of state-level disability insurance. How much you can expect to come. AGGIEFIT AggieFit Membership Miscellaneous Deductions AL TAX Alabama State Income Tax Taxes AR TAX Arkansas State Income Tax Taxes ASA NMSU Aggie Scholarship Assoc.

I just received my first paycheck at a new job I started two weeks ago I have a 65000year salary - the base earnings for 40 hours is 1250. Common pay stub deduction codes include the. FIT on a pay stub stands for federal income tax.

To calculate your tax bill youll pay 10. Fit stands for federal income tax. The amount of FICA tax is 153 of the employees gross pay.

Answer 1 of 2. SIT stands for State Income Tax. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

Withholding is one way of paying. Federal income tax deduction refers. Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle.

The amount of FIT withholding will vary from employee to employee. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Fit deductions are typically one of the largest deductions on an earnings statement.

Ariel SkelleyBlend ImagesGetty Images. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. S 0 Single 0 Exemptions From W-4 what is.

Pay Stub Deduction Codes What Do They Mean. It stands for Federal Income Tax. They go toward costs needed to run the federal government.

All but seven states AK FL NV SD TX WA and WY have state income taxes. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Understanding the Implications of FIT.

Pre Tax Vs Post Tax Deductions What Employers Should Know

What Are Pay Stub Deduction Codes Form Pros

What Everything On Your Pay Stub Means Money

A Guide On How To Read Your Pay Stub Accupay Systems

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

What Are Pay Stub Deduction Codes Form Pros

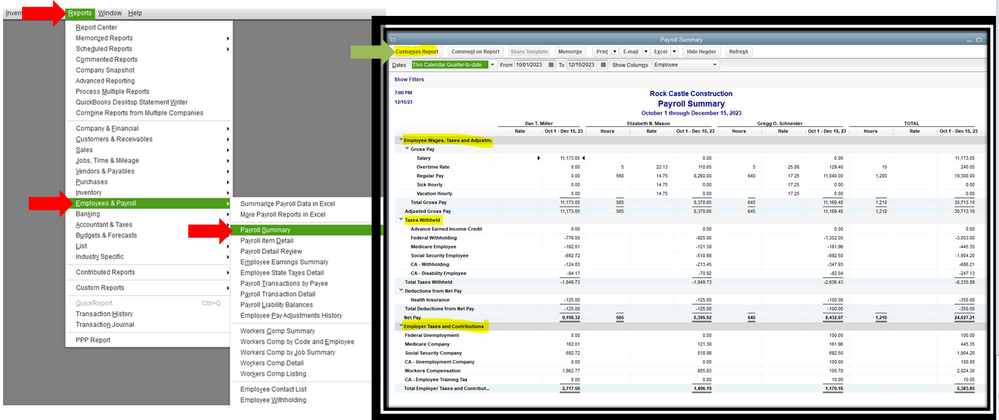

Federal Income Tax Fit Payroll Tax Calculation Youtube

Different Types Of Payroll Deductions Gusto

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Hrpaych Yeartodate Payroll Services Washington State University

Understanding Your Pay Statement Innovative Business Solutions

Solved Federal Taxes Not Deducted Correctly

W2 To Paystub Reconciliation Wyoming State Auditor S Office

Understanding Your Paycheck Credit Com

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube