reit tax benefits ireland

As part of Budget 2013 it was announced that there would be legislative changes facilitating the establishment of REITs in Ireland and for investors to directly hold property. Aim to set your family up well long-term.

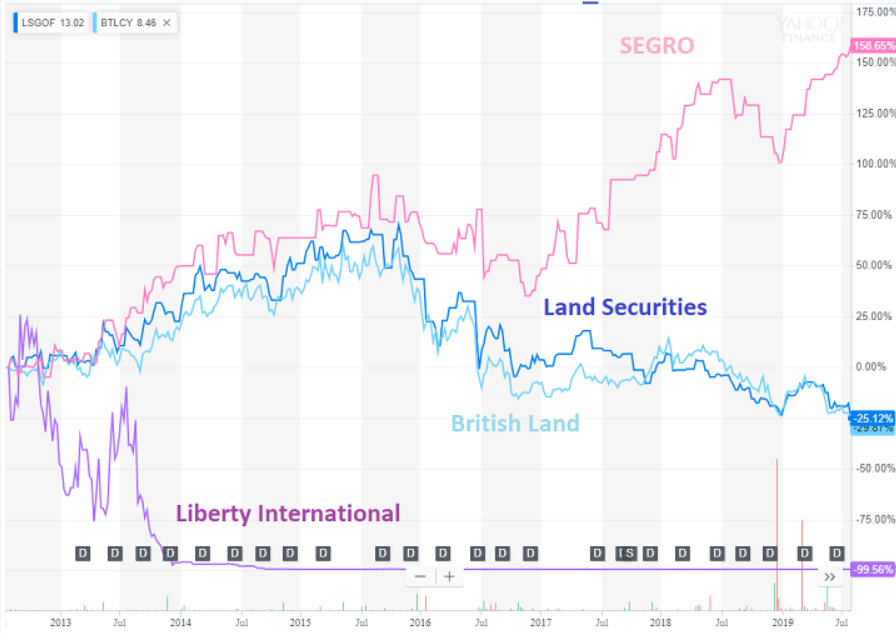

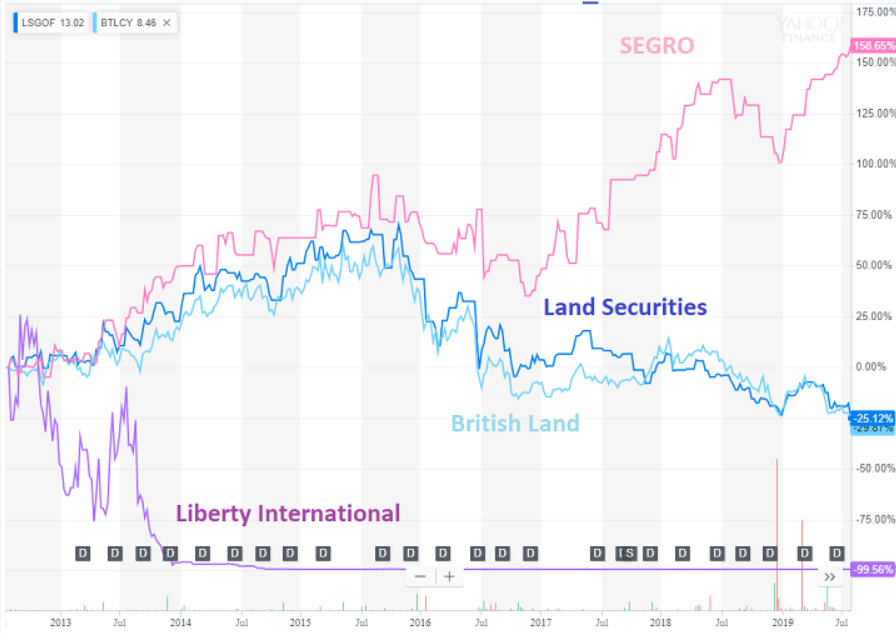

It S Tea Time Our Top Growth And Income Reits In The U K Otcmkts Btlcy Seeking Alpha

A REIT must invest at least 75 of its assets in real estate and cash and obtain at least 75 of gross income from sources such as rent and mortgage interest.

. A REIT is exempt from corporation tax on qualifying income and gains from rental property subject to a high profit distribution. Taxation of an Irish REIT Companies which meet all the criteria imposed by the local authorities will be exempted on the corporation tax applicable to the rental profits or the property gains. 1 Taxation to.

For example the France UK tax treaty allows REITs to benefit. Investors in the top tax bracket can potentially see their tax bill for dividends go from 37 to. Ad Easy Access to Commercial Real Estate with Low Fees Ground-Breaking Liquidity Potential.

Generate potential passive income with Cadre. This guide looks at the tax treatment of UK REITS. And The company must have a diverse.

Nevertheless a REIT will be obliged to. Our Portfolios Of Publicly Traded Real Estate Companies Help Reach Investor Objectives. Introduced by the Finance Act 2013 a REIT is an Irish resident company which derives at least 75 of its income from renting property whether commercial or residential.

Aim to set your family up well long-term. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. A 20 withholding tax may be levied in Ireland on such distributions although relief will be available under many double tax agreements.

They are generally exempt from Corporation. Ad Easy Access to Commercial Real Estate with Low Fees Ground-Breaking Liquidity Potential. Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios.

Or group of connected persons can control the REIT. Which Ireland has a double taxation agreement DTA or treaty may be able to reclaim some of the DWT if the relevant tax treaty permits. The main tax implications of electing for REIT status are.

Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. REITs are partial conduits because unlike corporations in general REITs may deduct dividends paid in determining taxable income. Irish resident shareholders in a REIT will be liable to income tax on income distributions from the REIT plus PRSI and USC.

Generate potential passive income with Cadre. First the tax treaty can expressly mention the REITs as beneficiaries of the provisions of the tax treaty. Value added tax VAT will be payable unless the transferor is a taxpayer engaged in real estate business.

Sale of shares of the REIT through the stock exchange will be exempt from DST and. Qualifying property companies can elect for REIT status. Our Portfolios Of Publicly Traded Real Estate Companies Help Reach Investor Objectives.

Various conditions of the legislation the REIT will not be liable to corporation tax on income and capital gains arising from its property rental business. Legislation introduced in 2013 allowed for the establishment of Reits which are generally exempt from corporation tax and levies on gains from property values or capital. Where shares in a REIT are held by an investment.

Irish resident corporate investors will be liable to 25 corporate tax. Irish REITs will be listed on the main. Real Estate Investment Trusts REITs REITs are companies who earn rental income from commercial or residential property.

Thus in general a REIT owes no federal. Real Estate Investment Trusts REITs are recognised as important vehicles for property investment in over 30 jurisdictions throughout the world.

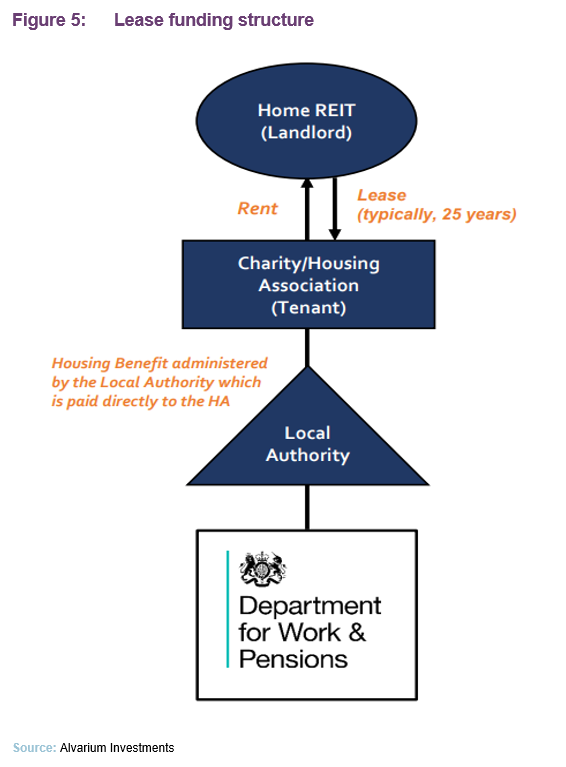

Home Reit Tackling Homelessness Ipo Quoteddata

Real Estate Investment Trusts In Ireland

Tax Regimes Across Leading Reits Frameworks

Stratus Properties Inc Oasis Management Co Ltd Dfan14a April 15 2021

It S Tea Time Our Top Growth And Income Reits In The U K Otcmkts Btlcy Seeking Alpha

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors